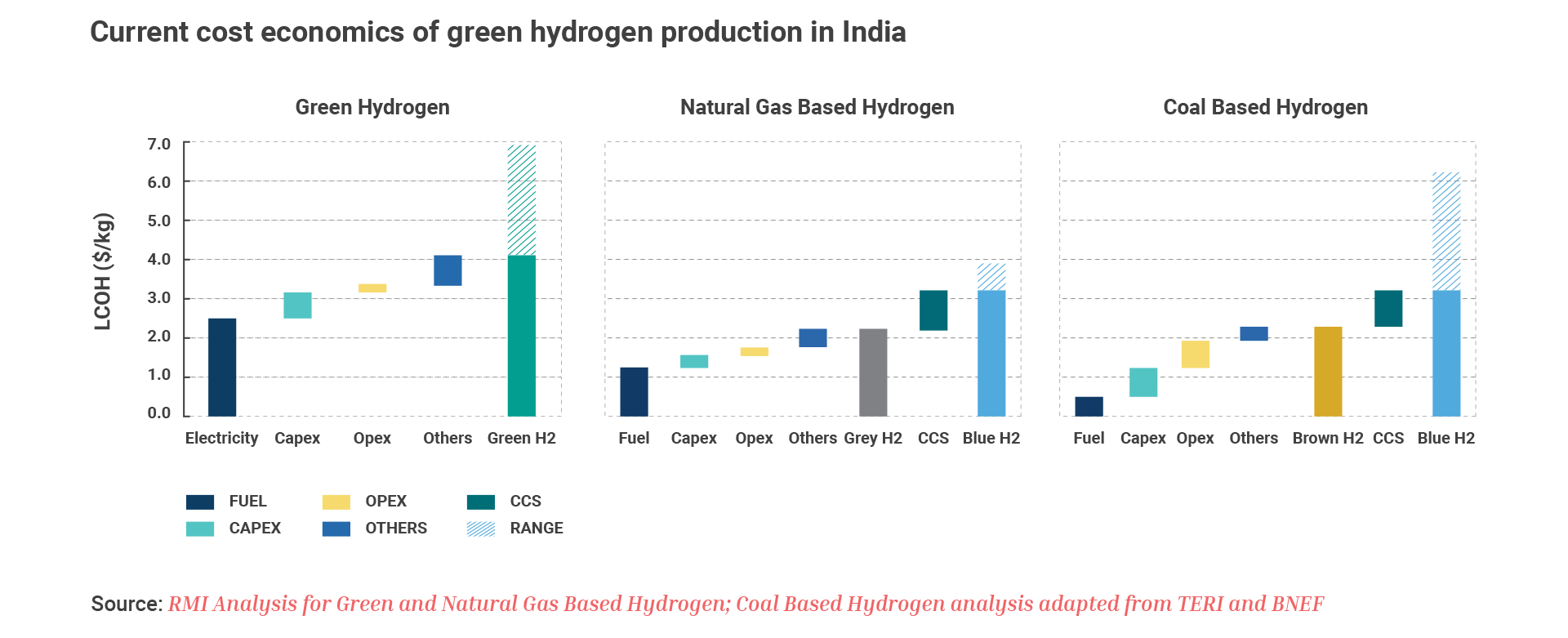

Amidst all the clamor and buzz around e-vehicles, Hydrogen has turned up as a paramount alternative towards building clean energy solution . Green Hydrogen allows storing of energy from renewables with an added advantage of long-distance transportation. Besides a lot of excitement in the private sector, the Government of India also has yearned on the impact of Green Hydrogen for India’s future energy needs. Some major policy and government actions taken in the recent past can be summed up in the way –

India needs to form Green Hydrogen

Corridors: Niti Aayog

Adani and Total Energies to create the

world’s largest green hydrogen ecosystem

Amara Raja bags India’s first

green hydrogen fueling station project

OIL sign pact with homi Hydrogen for

green hydrogen

India has scope to produce hydrogen

from domestic coal: Expert panel

MoU for joint development of green

hydrogen solutions in India

As per the latest estimates, India utilizes over $160 billion of foreign exchange every year for energy imports, which is expected to double in coming two decades. As per the Niti Aayog’s Report- ‘Harnessing Green Hydrogen- Opportunities for Deep Decarbonization in India’, India can achieve the following milestones if right steps could be taken and an ecosystem around Green Hydrogen is harnessed –

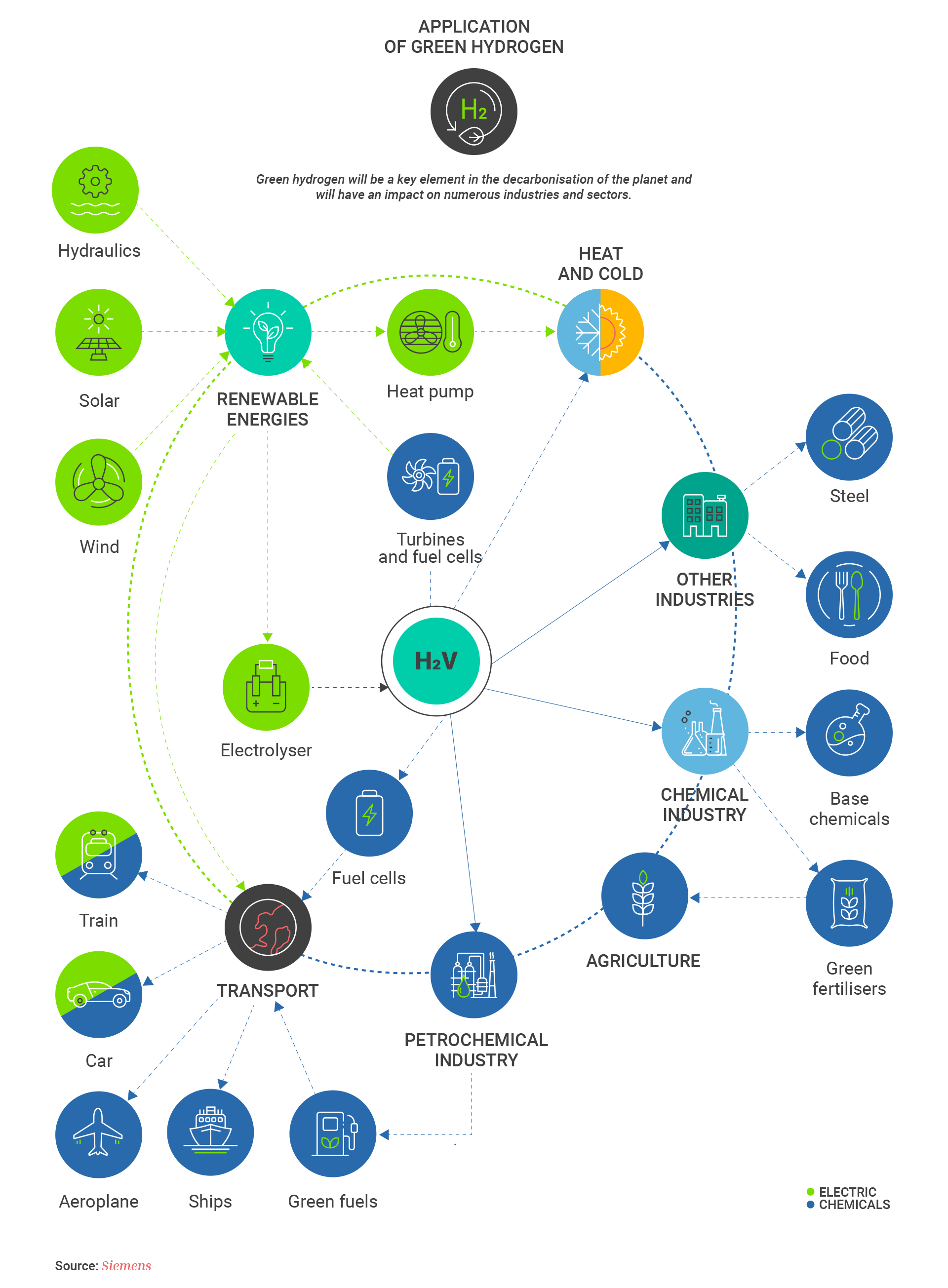

In order to achieve the above targets, India would need largescale investments in the field of Green Hydrogen, which can unlock huge potential available in terms of power generation, transportation, fertilizer, construction among various other fields. Apart from domestic consumption, Indian companies can also tap the widescale markets abroad.

The main cost determinants for the production include the cost of electrolyser, electricity, operation, transmission & distribution, and lastly duties & taxes. Currently, the levelized cost of hydrogen (LCOH) stands between $4.10/kg-$7/kg, however this can be optimized to less than $3.5/kg in very short term, $1.60/kg by 2030 and $0.70/kg by 2050.

India already possesses a distinct advantage in low-cost renewable electricity. The recently unveiled policy has already waived off some duties and charges. Considering a scenario where the Government is to extend other incentives like GST waiver (18% to 5%), Full T&D waiver etc.

and prudent capital expenditure is taken on the electrolyser capacity, the cost of electrolysers can fall from 500 $/kW (2020) to 125 $/kW (2030).

By 2030, if not before, India’s green hydrogen production can be made vis-a-vis fossil-fuel based hydrogen ($3.2/kg) and green hydrogen’s production in other countries.

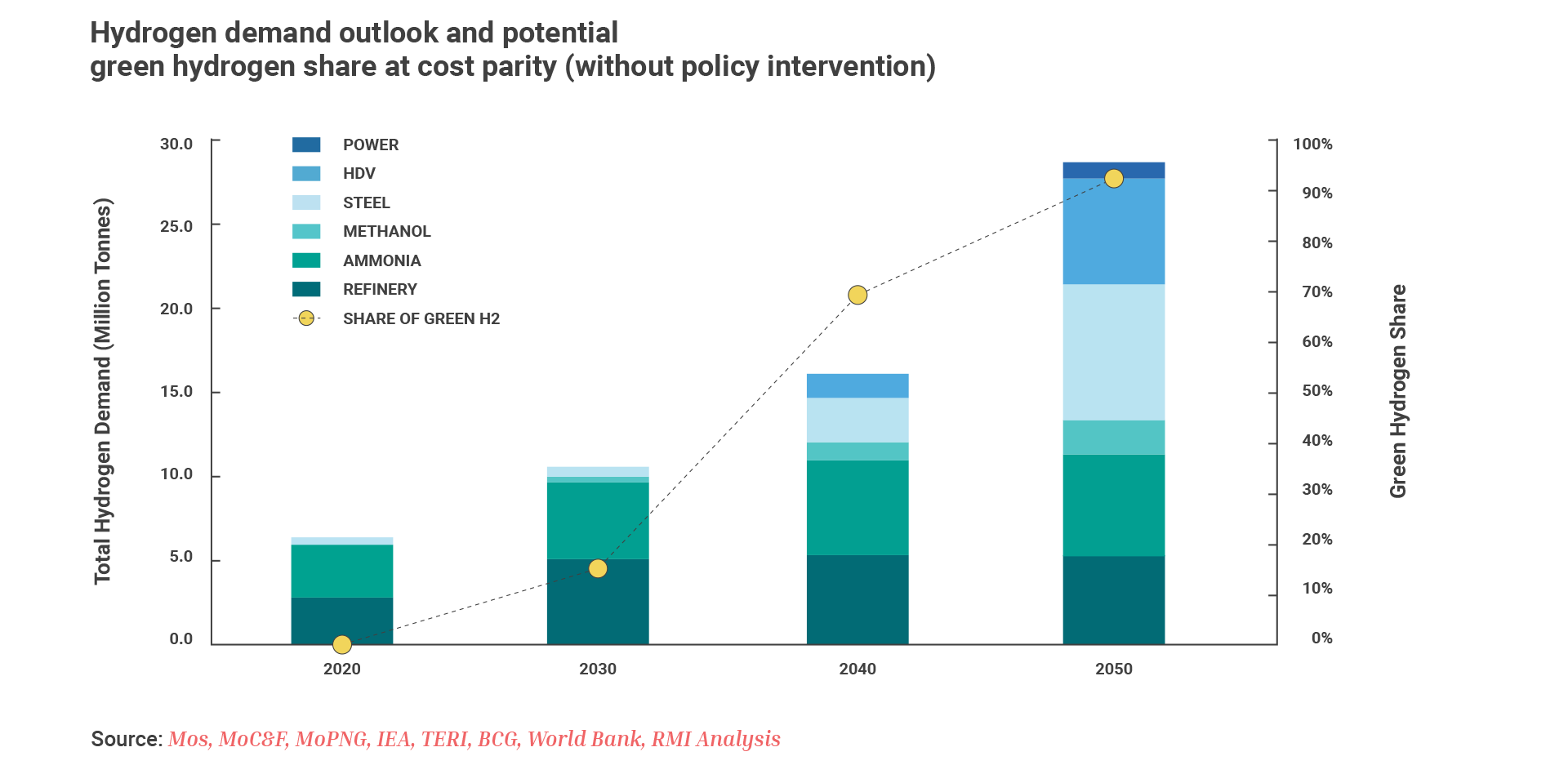

The Niti Aayog estimates that apart from the disruption in Green Hydrogen, the electrolyser market itself can be huge in India. It states that India’s own internal market for electrolysers could be around $31 billion by 2050 representing a demand of 226 GW as compared to 20GW in 2030.

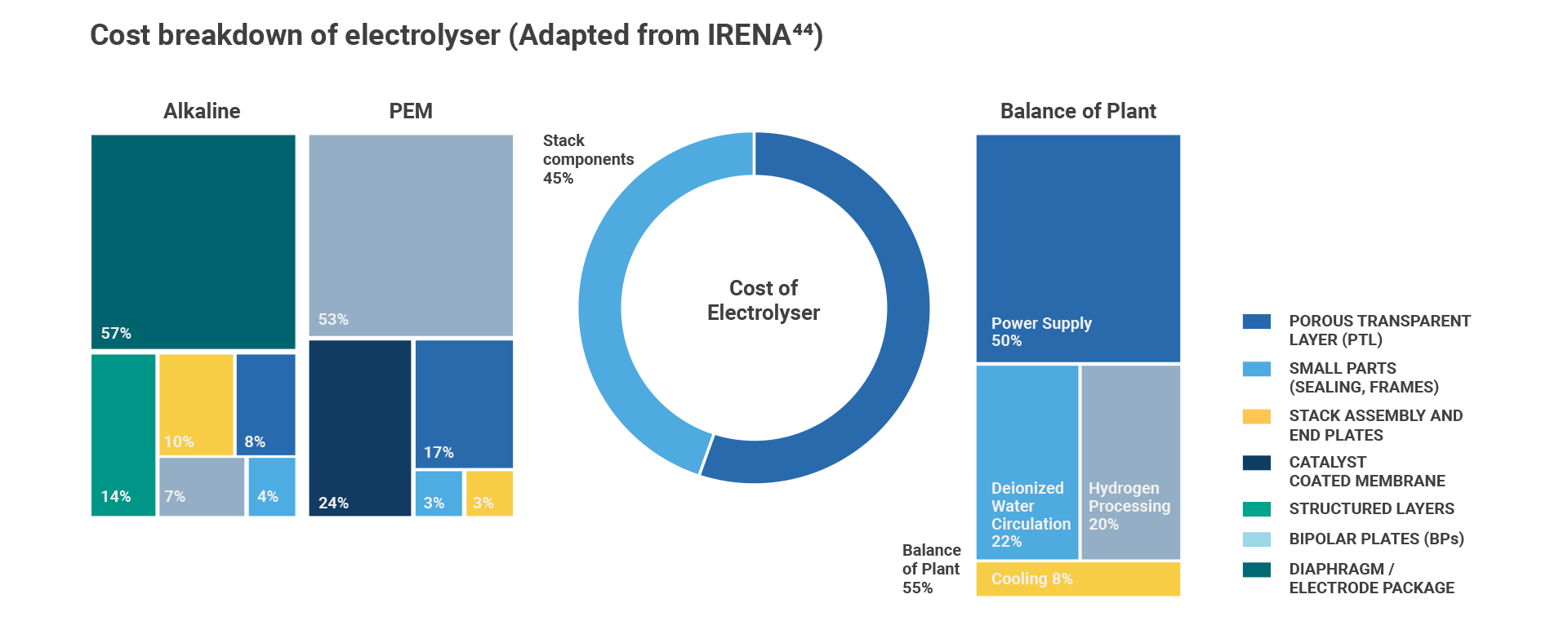

This opens a gigantic domestic manufacturing opportunity in India in the components for electrolysers, which include stack manufacturing, small parts (sealing, frames), stack assembly and end plates among others. In the backdrop of the fact, that power supply, water circulation, and hydrogen processing units account for 50% of the electrolyser costs, which can be further reduced, India can emerge as key player in the global electrolyser market by emulating the progress it is making in the electronics space.

Apart from domestic market, enormous export opportunities can be tapped by India. Japan and Australia are already working on a Hydrogen Energy Supply Chain (HESC) Project, one of the first initiativer to ship hydrogen over the ocean. As per TERI, even by 2030, Indian green hydrogen could be competitive at the margin for select geographies.

Unlocking large-scale production in Green Hydrogen needs upfront investments, given the less dense properties of hydrogen which either mandate its liquification or compression, in order to deliver it as a compressed gas. This preliminary analysis may not adequately capture the specific grounds on individual cost points, but the increasing adoption of Hydrogen around the world, and India’s impending efforts to reduce the dependence on fossil fuels, convincingly paints the potential India can harness in the field of Green Hydrogen

Almost all the major economies around the globe have already placed huge bets by investing heavily in hydrogen-based technologies. India should play to its strengths in terms of growing renewable energy capacity and invest in the right areas to accelerate the economic viability of Green Hydrogen. The Government’s intent has been clear right from the top that it is willing to provide necessary policy support. Thus, investing in Green Hydrogen apart from decoding the clean fuel challenge, can also exacerbate a new sector with abundant manufacturing opportunities targeting both domestic and international markets.